This multifamily residential properties program is a mortgage loan insurance product backed by Canada's Housing Authority. It offers attractive incentives for real estate investors and developers focused on affordable, accessible, and energy-efficient rental housing.

Key benefits for investors include:

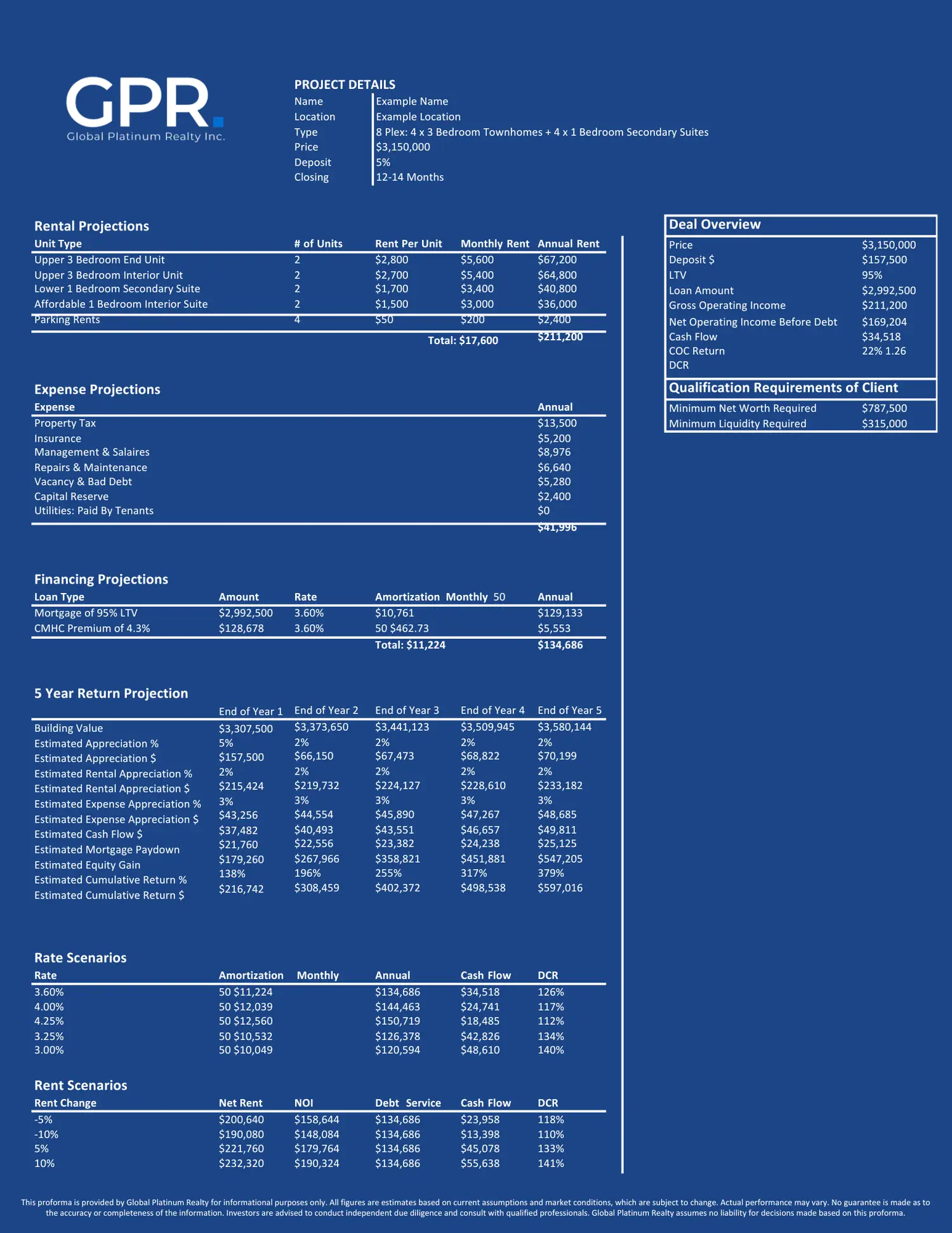

- Higher loan-to-value (LTV) ratios

- Amortization periods up to 50 years

- Lower interest rates

This government-backed financing option enhances support for long-term rental multifamily housing solutions. It is available exclusively to Canadian investors and can be used for multifamily projects owned individually, jointly with other investors, or through affiliated companies.

High Home Prices: Despite some market corrections, the cost of purchasing property remains high, driven by elevated demand and limited supply.

Increased Borrowing Costs: The Bank of Canada’s rate hikes have driven up mortgage rates, making financing significantly more expensive for investors and developers.

Lower Cash Flow: As borrowing becomes more expensive, monthly mortgage payments increase, reducing the profit margin from rental income. Many pre-construction investors struggle to achieve positive cash flow in this environment.

Increased Scrutiny for Pre-Construction Projects: Some lenders are hesitant to finance pre-construction projectsdue to market uncertainty, requiring developers and investors to secure alternative funding sources, often at higher costs.

01

Affordability

1) A percentage of units must be rented at the median market rent in the area.

2) Projects offering lower rents receive more points, qualifying them for higher incentives.

02

Energy Efficiency

1) Projects must improve energy performance by at least 25% above the building code requirements.

2) This can include upgrades such as energy-efficient HVAC systems, insulation, and solar panels.

03

Accessibility

1) Builders must incorporate features like wide hallways, roll-in showers, lower counters, or wheelchair ramps to accommodate individuals with disabilities or mobility challenges.

Developer Approved Platinum VIP Agents

Global Platinum Realty

Real Estate Brokerage

About: https://globalplatinumrealty.com/

Head Office: 7 Grand Ave. S., Unit 114, Cambridge, ON

Client Line: (647) 360-5016

Email: info@globalplatinumaccess.com

Click here to book a meeting with one of our team members.

*Terms & Conditions Apply – See Sales Representative For More Information

**We do not represent the builder. All renderings, incentives, pricing are subject to terms & conditions are may change at anytime without notice – see sales representatives for more details. E&OE

© 2025 by Global Platinum Realty Inc.